Choosing the coin to Invest

Investing in cryptocurrencies is one of the ideas that should be running through your mind when you consider various investment vehicles for investments. Unlike stocks, crypto has been a “lucrative” field for those who are able to make the right choices on buy or sell positions.

Last year (2017), Bitcoin prices were on a persistent rise going up to $2000 per bitcoin. On the other hand, crypto has brought a new fundraising model referred to as Initial Coin Offerings, you can view our previous article on ICOs here.

ICOs is a fundraising model using crypto and it’s open to a wide range of investors across the globe. ICO is very similar to a shares Initial Public Offering where members of the public are invited to subscribe to buy shares of a company.

In this article, I have taken a post that was originally posted in Coincentral by Steven Buchko

Initial Coin Offerings (ICOs) have quickly become the standard for blockchain startups to raise funding for their project. In an ICO, the team hosts a crowd sale in which you purchase tokens that you can use on their platform. You can also trade these tokens in the secondary market (exchanges) after the ICO.

For example, Golem held an ICO to distribute the first GNT tokens. The purpose of these tokens is to purchase computing power in the Golem network, but traders also buy and sell them on exchanges.

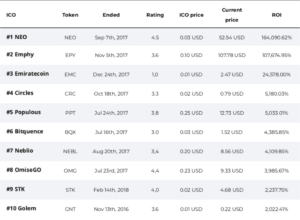

Participating in ICOs can be a lucrative trading strategy. If you invested in the NEO crowdsale (at the time the project was called AntShares), your return on investment (ROI) would be ~160,000% currently. Populous, about 5,000%. OmiseGo, around 4,000%. You get the picture.

ICO Research

It’s important that you do your due diligence when picking what cryptocurrency to invest in pre-ICO. There are a ton of things to look at when evaluating a cryptocurrency, but the most important attributes are:

- Team and advisors – The team should have experience in blockchain technology or at least the industry that they’re targeting. Preferably both. Having reputable advisors is also a strong sign that the ICO could succeed.

- Clear problem/solution – The project’s white paper should clearly define what problem the project is aiming to solve and how the cryptocurrency solves it. Make sure it’s not just a document full of marketing BS.

- Token distribution – The team should be distributing over fifty per cent of the tokens to crowdsale participants if not much, much more. Be hesitant about projects in which the team and advisors keep a significant proportion of tokens.

Other things to take note of are: any notable partnerships, whether the team has already created a product, and the size of the industry they’re targeting. All of these things could lead to a favourable investment.

Check Lesser Known Exchanges

Even if you missed your chance to participate in an interesting ICO, you can still invest once the coin hits exchanges. At this time, there’s often a brief spike followed by an immediate dump as ICO investors look to cash-in on short-term gains. This is a prime opportunity to get coins you’re interested in for ICO-level (or even lower) prices.

Beyond the short post-ICO period, you still have time to invest in a coin before major exchanges begin to list it. Cryptopia and decentralized exchanges such as IDEX are goldmines for these types of coins. The same research strategies mentioned above apply to coins in this category as well.

Search through coins with a small market cap (<$100 million) that haven’t been listed on a large exchange like Binance yet. You can check CoinMarketCap to see which exchanges coins are on. Make sure you research appropriately and find coins that you believe to have solid fundamentals.

Once you’ve found a coin you’re confident in, purchase it, and (this is the hardest part) wait. It could take days, weeks, or even months for your coin to reach a respectable amount of awareness. If you truly believe in the fundamentals of the coin, though, this timeframe shouldn’t matter. Once the coin joins a major exchange, feel free to trade it accordingly.

Time Important Events

Another popular strategy in selecting what cryptocurrency to invest in is to choose coins based on project roadmaps and event calendars. This is a short-term strategy and usually much harder to execute than the other ones that we’ve covered.

The price of cryptocurrency tends to rise after an important partnership announcement or development milestone. If you follow certain projects on Twitter or are active in their Telegram channel, you usually find out about these announcements ahead of the less involved general public.

With that information, you can sometimes buy into a project early and ride the wave up following the announcement. This has some potential downsides, though. Correct timing is incredibly difficult to accomplish. And, in a bear market, even the most impressive announcements can get crushed under the negative sentiment.

Additionally, the rest of the market may not react to the news the way that you expect. A recent example of this is Verge’s PornHub partnership announcement. While some supporters saw this as positive news, the majority of the market didn’t, and the price crashed accordingly.

Stay Vigilant

Most importantly, you just need to stay vigilant when looking for what cryptocurrency to invest in. New investment opportunities occur every day when you’re actively looking for them. Join subreddits, follow crypto traders on Twitter, and constantly research new projects – in essence, engulf yourself in the blockchain space. You never know what gems you’ll stumble upon.

This article was originally posted on Coincentral authored by Steven Buchko

More from my site

CryptoKibao is your one stop website for news and updates on cryptocurrencies. We also have tutorials you can download on crypto trading and an online learning resource portal https://academy.cryptokibao.com

Comments