Bitcoins are a digital currency that has been in existence since 2008 when it was made open source. Bitcoin was developed by a group of programmers who used the pseudonym Satoshi Nakimoto. Bitcoin value has been volatile with the prices fluctuations, in the year 2017 the value skyrocketed beginning at a low position of around $800 by January and closing at a high position of $ 20000, the rise in price was and is still claimed by some sceptics to be a bubble.

what is a bubble in a simple language?

In this article, we are going to discuss what is a bubble and its characteristics and finally conclude whether bitcoin is a bubble or not.

A bubble is an economic cycle that is characterized by the rapid escalation of an underlying asset price followed by contraction. It’s a period of intense speculation in the market, causing prices to rise quickly to irrational levels as the metaphorical bubble expands, and then fall even more quickly as the bubble burst

Other terms used as synonyms include: “financial bubble” “speculative bubble” “asset price bubble”. One key fact to note is the rapid rise in the price of the value of the asset over a short period before finally bursting when the asset loses value drastically.

Bitcoin has been branded by some as a bubble that is just about to burst however the question of when is a matter of time.

Some of the “Financial Bubbles” that have Occurred

Historically there has been some other bubbles that burst in the past after a rise in prices, this includes the following;

Image Credit marketwatch.com

1. The Dutch Tulip Bubble

This is probably the earliest bubble that ever existed, it occurred in Holland in the 1630s when Speculators traded flowers traded for extraordinary sums of money. As people heard of success stories of how others were making it in the business of buying and selling tulip flower bulbs they also ventured into in and the prices skyrocketed up to 20 times between Nov 1636 and Feb 1637 before crushing by 99% in May 1637. The tulip bulb price was inflated to the extent that a single flower exceeded the annual income of a skilled worker. As the prices dropped many tulip holders went bankrupt.

2. South Sea Bubble

South sea was a company formed in 1711 in the UK and had been promised a monopoly by the British Government on all trade with the Spanish colonies. The company was playing on a bet to replicate of a similar company East India Company which was paying tax-free divided to investors from a similar venture. The directors of the company were circulating tales of unimaginable riches in the South Sea –present-day South America. Shares of the company surged more than eight times in 1720 from £128 in Jan to £1050 by June before collapsing in the subsequent months.

3. Japan Real Estate and Stock Market Bubble.

The Japan economic bubble occurred between 1986 and 1991 when real estate and stock market prices were greatly inflated the bubble was characterized by the rapid acceleration of asset prices as well as the uncontrolled supply of credit expansion. In the 1980s the Japanese Yen had surged by 50% which triggered a recession in 19856, the government in encountering it through monetary and fiscal policy, and measured worked so well that they posted speculation resulting in stocks and land values tripling from 195 to 1989, the bubble subsequently burst in early 1990.

4. The Dotcom bubble

This is the most common type of economic bubble. This occurred during the period of excessive speculation that occurred roughly from 1997 t 2001, a period of extreme growth in the usage and adoption of the internet. During the period many internet-based companies were founded and investors massively invested in them with the hope that those companies would become one day profitable. Dotcom internet companies achieved multi-dollar valuation as they went public, however when the bubble burst some companies shut down while other stock prices declined by over 86% losing over half of their market capitalization

5. The US housing bubble

During the US housing bubble, the price index of US house prices doubled between 1996 and 2006. Housing prices peaked in early 2006 but started to decline in 2006 reaching a low by 2012.

6. Quail Business

This is a local case in Kenya which may not be documented as a bubble but as a good local example for understanding. The quail eggs business had boomed in Kenya. This was a business where people reared Quail birds for their eggs which were said to cure numerous diseases. The business later collapsed when the demand for the quail eggs was no more and most people lost the money they had invested in establishing the business

From the examples listed above, you will note common characteristics, the business starts low by few who venter in the early day, then as they peak and more people become aware of the opportunity venture into it making the prices hike beyond the intrinsic value of the products. Finally, the prices fall drastically when people want to sell off and there are no more buyers or investors coming into the business model.

Image Credit marketwatch.com

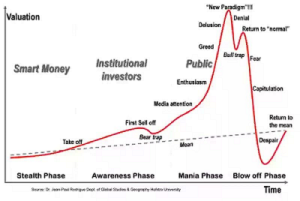

Stages of a Bubble

Stealth Phase

At this stage, smart people realise an emerging opportunity which has a substantial future appreciation. These people tend to have access to information and a higher capacity to understand the wider economic context that would trigger asset inflation. During this stage, the underlying asset price rises gradually unnoticed by the general public.

Awareness Phase

During this stage, the public notice the momentum, and the media also gives a wider coverage. As more people learn about it more money is brought in pushing prices higher. There could be short-lived sell-offs as the early investors cash out their profits. In the later stages, the media start covering positive reports of how this boom could be helpful to the economy.

Mania

At this stage, everyone is noticing that prices are going up and the general public jumps in for what is referred to as “n opportunity of a lifetime”. People are now in the mode of “psychological investing” doing it because others are successful at it for the Fear of missing out. More money comes in creating greater expectations and pushing prices to higher levels. The more people, the more investment pours in. By this stage, the smart investors are usually pulling out.

Blow off

Finally, the trend changes, and confidence and expectations shift. The price starts dropping, and many people try to sell off but the buyers are few as compared to the sellers pushing the price even deeper.

Bitcoin may not have shown all these signs though some have called it a bubble. The number of users in the community is wide and spread across the world, with the increased regulation by most governments the prices may slightly surge but eventually go high. It’s head to predict when a bubble can burst.

More from my site

CryptoKibao is your one stop website for news and updates on cryptocurrencies. We also have tutorials you can download on crypto trading and an online learning resource portal https://academy.cryptokibao.com

This is very interesting, i didn’t even know what was a bubble